Economic Overview

The market experienced a decline during the previous week because investors became concerned about new trade tensions and increasing borrowing costs and rising US government debt. The market experienced a setback when President Trump announced unexpected European import tariffs including iPhones at a time when China trade negotiations were showing positive developments. The new trade policy brought back the uncertainty that had previously dominated the market.

Adding to the pressure, bond yields in the US jumped after a weak government debt auction, reflecting investors' worries about how much money the US is borrowing and spending. A major new tax-and-spending plan in Washington is expected to add over $3.8 trillion to the national debt. Meanwhile, in the UK, inflation surprised to the upside, delaying any hopes for near-term interest rate cuts.

Despite these headwinds, not everything was gloomy. Some defensive areas of the market held up, gold gained as a safe haven, and a weaker dollar helped overseas assets. Still, after several weeks of calm, markets showed renewed signs of caution as summer approaches.

Equities, Fixed Income, and Commodities

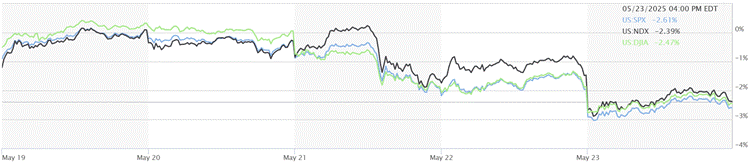

Stock markets around the world struggled. The S&P 500 dropped 2.61%, the Nasdaq-100 fell 2.39%, and the Dow lost 2.47%, marking the biggest weekly decline since March. A midweek sell-off was triggered by a mix of rising interest rates and new tariff threats that made investors nervous.

Index Performance

Source: MarketWatch. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 23 May 2025.

Coinbase, which recently joined the S&P 500, continued to grab headlines. While it saw some ups and downs, the stock stayed above its entry level as investors remained hopeful about crypto's long-term role. Apple, however, had a rough week, falling more than 6.0% as worries about tariffs and profit-taking took a toll.

In the bond market, 10-year US Treasury yields climbed as high as 4.59% before settling around 4.53%. This was driven by weak demand at a bond auction and anxiety about rising debt levels. Short-term yields didn’t move much, as traders still expect the Fed to cut interest rates later this year.

UK government bond yields jumped too after April inflation came in hotter than expected, pushing back hopes of a rate cut. Across Europe and Japan, long-term bond yields also moved up, reflecting global concerns about interest rates staying high for longer.

Oil prices were steady. Brent crude hovered around $65 per barrel. Talks between the US and Iran didn’t progress, which supported prices, but slower growth in China weighed on the demand outlook. Gold, on the other hand, rose more than 2% to stay over $3,300 per ounce, as investors moved money into safer assets.

Sector Performance Updates

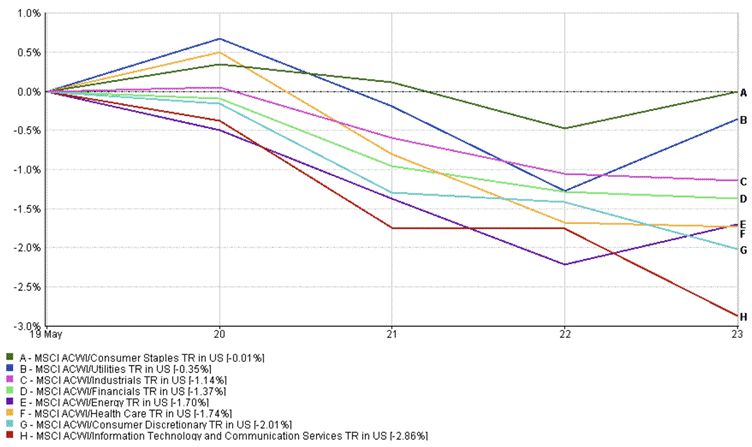

Last week, investors gravitated toward steadier parts of the market. Consumer staples, which include everyday essentials like food and household goods, were the most stable, ending the week nearly flat (-0.01%). Utilities, such as power and water providers, slipped only -0.35%, while healthcare stocks were down -1.74%, all showing that investors preferred more reliable sectors during a stormy week.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 23 May 2025.

In contrast, technology and communication services saw the biggest losses, dropping –2.86%. Apple’s rough week and caution ahead of Nvidia’s earnings dragged the sector down. Consumer discretionary stocks, which include retail, travel, and luxury brands, also fell -2.01% as concerns about tariffs and tighter household budgets weighed on sentiment.

Energy stocks dipped –1.70%, tracking sideways with oil prices. Industrials dropped -1.14%, as fears of renewed trade disruptions put pressure on companies tied to global manufacturing and shipping. Financials, including banks and insurers, declined -1.37% after bond market volatility made the outlook for interest rates more uncertain.

Regional Market Updates

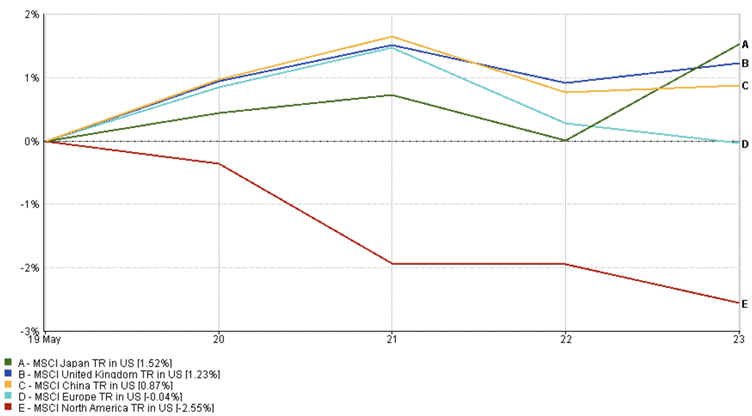

Markets around the world had mixed results last week. The MSCI North American Index experienced the largest decline at -2.55% because technology stocks and smaller companies performed poorly. The US market ended its winning streak because of rising interest rates and new trade conflicts which decreased investor confidence.

Europe maintained better market performance than other regions. The European market maintained a flat position throughout the week (-0.04%) while showing resistance to market volatility. The MSCI United Kingdom Index increased by 1.23% because of a new UK-EU defense agreement and positive performance from consumer and financial sector stocks. The UK inflation rate unexpectedly increased during the middle of the week, which limited market optimism.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 23 May 2025.

Japan maintained its position as the market leader with a 1.52% increase despite investors selling stocks at the end of the week. The market started the day positively because of the weaker yen and strong earnings but investors became more cautious when local bond yields increased during the last part of the week. The Chinese market experienced a 0.87% increase in value, but its performance remained inconsistent because of ongoing worries about technology regulations and trade conflicts.

Currency Market Movements

Currency markets were more active this week, driven by shifting interest rate expectations, safe-haven flows, and renewed concerns over US fiscal policy.

EUR/USD rose steadily throughout the week, opening at 1.1244 on May 19 and climbing to 1.1365 by May 23 – a gain of approximately +1.08%. The move was supported by broad dollar weakness and expectations that the ECB may keep rates steady longer than the Fed.

USD/JPY declined sharply, starting the week at 144.86 and ending at 142.57, marking a -1.58% drop. The yen benefited from safe-haven demand and a jump in Japanese bond yields, which helped narrow the gap between US and Japanese interest rates.

GBP/USD strengthened as well, opening at 1.3362 and closing at 1.3538, up +1.32% for the week. The British pound was boosted by hotter-than-expected UK inflation data, which led traders to delay their expectations for BOE rate cuts.

GBP/JPY was relatively flat on net. The pair opened at 193.56 on May 19 and closed at 193.00 on May 23 – a modest weekly decline of –0.29%. Yen strength in the latter half of the week offset earlier pound gains.

Overall, the US dollar saw broad-based declines, with investors now questioning whether rising US yields reflect true economic strength or increasing fiscal risks. Rate divergence and inflation trends remain key drivers of FX market positioning.

Market Outlook and the Week Ahead

The shorter trading week allows markets to pause their activities because both the US and UK observe Monday holidays. The US markets will resume trading after the holiday to focus on three essential economic indicators: consumer confidence data and durable goods orders and core PCE inflation numbers which matter to the Federal Reserve.

The market will closely monitor Nvidia's earnings results following the recent fluctuations in technology stocks. Investors will monitor retail and consumer companies to determine spending patterns.

The European market will receive essential price stability information through inflation updates while Chinese manufacturing data will reveal if economic growth continues to strengthen. The market will focus on Fed speeches while monitoring any trade or US fiscal policy developments.

Investors have become more cautious following the market decline from last week. The market experienced increased volatility while the number of leading stocks decreased. Market stability becomes possible when inflation data matches expectations and companies deliver positive earnings reports. For now, it’s a balancing act between watching risks and staying open to recovery.